On June 2, 2022, Thailand’s Office of Insurance Commission (OIC) issued Notification No. 6 Re: Investments in Other Business Operations for both life and non-life insurance companies. The two notifications, which took effect upon issuance, strengthen the OIC’s supervision of investments by insurance companies, with a focus on basic infrastructure relevant to the promotion of business competition and sustainability, and also allow and regulate additional investment types.

Internal Governance of Investment Activities

An insurance company’s board of directors is required to appoint a credit committee when engaging in credit activities. These activities include providing loans (excluding personal loans to employees or loans made under a guarantee by its insurance policies), car leasing services, avals for bills of exchange, and letters of guarantee for project performance.

The credit committee has the following duties:

- Preparing the credit policy framework for the credit activities described above for further board approval;

- Supervising the credit activities;

- Overseeing good corporate governance, transparency, and prevention of conflict of interest in relation to credit activities;

- Ensuring that the work system, manpower, and data in relation to credit activities are sufficient; and

- Regularly reporting to the board of directors regarding credit activities.

Credit policies must at least cover:

- Procedures and conditions for credit transactions. These include risk management, internal controls, data storage, and written reporting requirements. The procedures and conditions must comply with the relevant OIC regulations and the Bank of Thailand’s minimum standards for financial institutions.

- Persons responsible for operations relating to credit work, risk management for credit transactions, and verification of credit transactions. These roles include (1) the credit analyst, (2) the person who approves appropriate credit transactions, (3) the verifier of work accuracy after a credit transaction is approved, (4) the person in charge of reporting credit transaction risks, and (5) the person responsible for verifying credit transactions and reporting this to the board of directors. Roles 1, 2, and 4 must not be the same person, and the team in charge of roles 1 and 2 must not be the same as the team handling roles 3, 4, and 5.

Permitted Investments

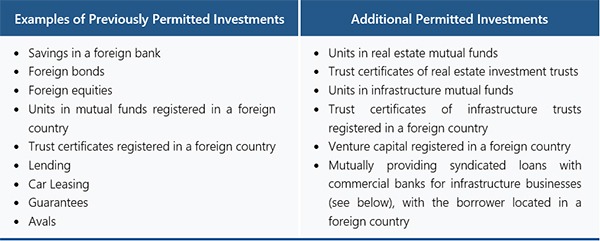

The notifications allow additional types of investment, as shown in the table below.

The aggregated amount of investment in the products listed above is capped at 30% of the total investment assets of the company.

Investment in Syndicated Loans

The OIC notifications introduce syndicated loans as a new type of permitted investment, and prescribe certain conditions for the investment in syndicated loans for infrastructure businesses. In this case, “infrastructure businesses” refers to Thai government-owned infrastructure businesses and infrastructure businesses located in the ASEAN region.

Insurance companies are permitted to invest in syndicated loans for the following types of infrastructure businesses:

- Rail or pipeline transportation systems;

- Electricity supply;

- Water supply;

- Airports or aerodromes;

- Deep water ports;

- Telecommunications or basic information and communication technology infrastructure;

- Alternative energy;

- Water management systems;

- Natural disaster prevention systems, including alarm and management systems for mitigation of natural disasters;

- Waste disposal; and

- Combinations of the infrastructure businesses listed above.

To invest in syndicated loans, an insurance company must possess the following characteristics:

- Capital surplus of at least THB 1 billion;

- Asset ratio of 110%;

- Capital adequacy ratio (CAR) for the latest four quarters of at least 200%; and

- Sufficient systems to support credit-related transactions.

Other Compliance Considerations

In addition to the rules for syndicated loans, the OIC notifications also prescribe rules for other types of investment.

Insurance companies that invested in loans, car leasing, avals, or guarantees before the issuance of the OIC notifications must also comply with the new rules, including appointing the credit committee (or alternative), instituting a credit policy, preparing credit-related data, and refinancing, within 180 days of the effective date of the OIC notifications (i.e., late November 2022).

For more details on the OIC notification, or on any aspect of insurance business in Thailand, please contact Witchupong Chittchang at [email protected] or Thammapas Chanpanich at [email protected].