Thailand’s Securities and Exchange Commission (SEC) has issued a new regulation on material transactions (MTs) to govern asset acquisitions and disposals by listed companies and their subsidiaries. The new notification on MT criteria (No. TorJor. 45/2568) from the Capital Market Supervisory Board replaces the long-standing notification (No. TorJor. 20/2551) that has governed such matters. The SEC has also introduced parallel amendments to the country’s related-party transaction rules.

The new regulation will take effect on July 1, 2026. Any MT matters approved by a company’s board of directors for shareholders’ approval before that date remain subject to Notification No. TorJor. 20/2551.

Following that date, the new MT rules will introduce several significant changes that market participants should carefully consider.

Expanded Scope of Material Transactions

One of the key changes under the new regulation is the expansion of the definition of MTs, which now expressly covers financial assistance and certain lease and business lease arrangements that are not in the ordinary course of business of the listed company or its subsidiaries.

For financial assistance, this includes lending, granting credit, providing guarantees, or entering into any arrangement that increases the company’s financial obligations, particularly where the recipient is facing liquidity issues or unable to repay debts. Other forms of financial support also fall within scope. However, whether the provision of collateral for others qualifies as an MT remains somewhat unclear, since no disposal of assets occurs for the provider of collateral. This issue remains to be carefully considered.

For lease-related transactions, the MT rules now specifically include the lease or hire-purchase of all or part of a business or assets operated by or belonging to a listed company or its subsidiaries.

New Exemptions

The new regulation introduces clearer exemptions for transactions between a listed company and its subsidiaries or among subsidiaries, which were not explicitly addressed under the old regime. Other exempt transactions include the establishment of a new subsidiary and liquidity management investments by a listed company or its subsidiaries.

In addition, if a subsidiary that is also a listed company fully complies with the MT requirements, the parent listed company is not required to separately comply for that same transaction (dual approval exemption).

Changes to Transaction Aggregation Rules

The new regulation extends the aggregation period from 6 months to 12 months. However, aggregation is now required only for transactions that are related or form part of the same project. Transactions that have already received shareholder approval remain excluded.

Revised Approval Thresholds and Process

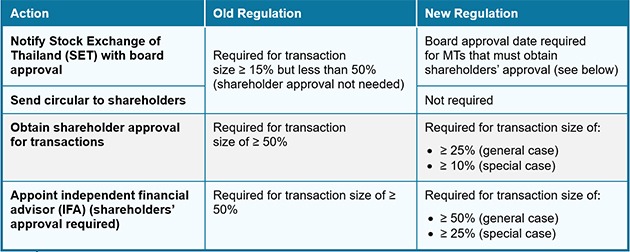

The new regulation lowers the shareholder approval triggering threshold, meaning more transactions may now require shareholder approval compared to the previous regulation, as detailed in the table below.

Under the new framework, a key shift is the reduction of the shareholder approval threshold for transactions from 50% to 25% in general cases, with an even lower 10% threshold for companies with negative net assets or operating losses, where the transaction may have an adverse impact (special case). At the same time, certain procedural steps have been streamlined, including the removal of the shareholder circular requirement.

Minority Veto Mechanism

The new regulation introduces a clearer minority protection mechanism. If the audit committee or the independent financial advisor opines that shareholders should not approve the transaction, the transaction cannot proceed if shareholders holding at least 10% of the voting rights present and eligible to vote object to it.

Progress Reporting Requirement

After obtaining shareholder approval, the company must disclose progress reports every six months (by January 31 and July 31) and include such updates in their Form 56-1 One Report until the transaction is completed.

The company must immediately report if it is unable to materially proceed with the transaction as approved, or if the transaction is canceled.

Next Steps

Market participants should review their internal policies, approval processes, and transaction monitoring practices in light of the expanded scope, revised thresholds, and new aggregation rules. In particular, financial assistance arrangements and transaction grouping analyses will require closer scrutiny under the new framework.

Given the scope of the amendments, further clarification from the SEC is expected. A formal guideline is likely to be issued, and both the SEC and the SET are expected to hold seminars to explain the new compliance framework in more detail. We will continue to monitor developments and provide updates as further clarification becomes available.