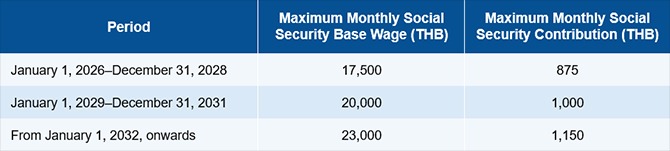

On December 12, 2025, Thailand’s Ministry of Labor published a ministerial regulation prescribing the minimum and maximum wages used as a base for calculating social security contributions. The regulation, which takes effect on January 1, 2026, sets a flat minimum base wage of THB 1,650 per month and a phased increase of the maximum base wage over the following six years, as outlined in the table below.

Impact on Social Security Benefits

Not only will monthly contributions increase as a result of the adjustment to the maximum wages used as a base for calculating social security contributions, but the maximum benefits available to insured persons will also be enhanced, as shown in the next table.

Employer Obligations

From January 1, 2026, employers must correctly withhold wages and remit social security contributions for both the employer’s and employees’ portions in compliance with the revised thresholds. Failure to comply may expose employers to penalties under the Social Security Act B.E. 2533 (1990).

Employers should ensure that payroll systems are updated as necessary to reflect these changes to the wage ceiling used for social security contribution calculations.