Thailand’s long-awaited new Trade Competition Act B.E. 2560 (2017) (TCA) came into effect on October 5, 2017, and the legislation’s extensive reforms of both substantive and procedural rules from the preceding version of the law have been both effective and revolutionizing. Significantly, the TCA lays out an efficient structure for the Trade Competition Commission (TCC) and grants independence to its administrative office, the Office of Trade Competition Commission (OTCC). Consequently, enforcement of this law—which had been almost absent in the past 20 years—is picking up pace. This article will examine the ongoing developments under this law in recent years, and will highlight its current application by discussing some of the TCC’s latest guidelines.

TCC: A Developer-Regulator

Since its establishment in 2018, the TCC has proven that its role and responsibilities are beyond those of a conventional regulator and law enforcer. The OTCC, with the support of its ad hoc subcommittees, have been actively monitoring the conduct of business operators and the level of competition in various markets and sectors, and the commission is well recognized for its publicizing of the TCA and establishment of new regulations under the law. Through various channels and platforms, a series of regulations, reports on market conditions, press releases, rulings, and precautionary statements have been published, and the TCC’s spokesperson often appears in the media to educate the public. To streamline the exchange of information and collaboration, the TCC and the OTCC have entered into an MOU with six sectoral regulators, including the Securities and Exchange Commission of Thailand, the Office of Insurance Commission, and others.

The TCC has also exercised its pre-emptive power to prevent suspicious trade practices and transactions. Prohibitive warnings have been issued against potential infringement, such as unfair trade practices by food delivery platform operators and a proposed merger by potentially market-dominating major hospitals.

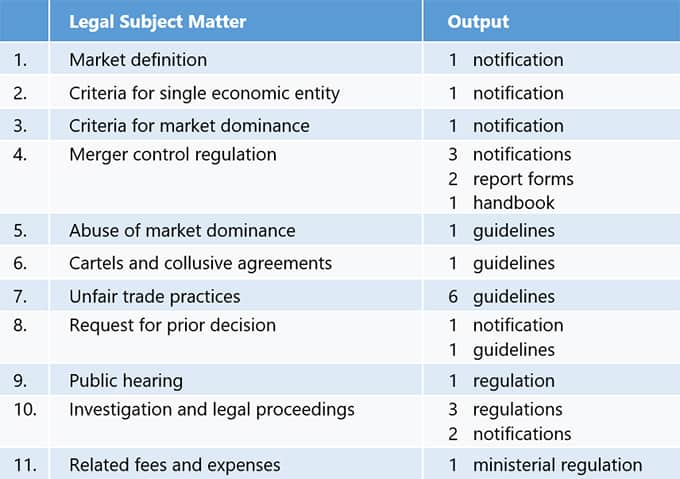

The TCC has realized that promotion of compliance is equally important to enforcement. Besides regulations and notifications, which set forth rules and restrictions, the TCC has started to promulgate handbooks, general guidelines, and market-specific guidance, as summarized in the table below.

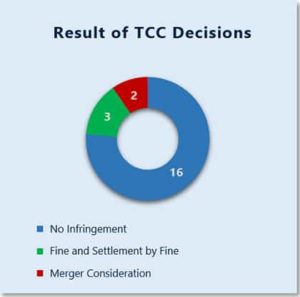

The TCC has the authority to rule on alleged violations and to approve or deny merger applications. All cases the TCC has received so far have been processed swiftly, and decisions—together with their reasoning—have been published with remarkable efficiency. The charts below illustrate statistics for the cases decided by the TCC during the 2019–2020 period. Notwithstanding the relatively low number of cases that resulted in penalties, it is notable that these penalties have been applied evenly and are far-reaching. The infringers on whom fines were imposed or cease-and-desist orders served include a large energy drink manufacturer, modern trade businesses, and a car supplier. Because of their reputations and the amount of the fines, these penalties have attracted much attention from the public and the media. Further public attention was garnered during the USD 10.6 billion acquisition of one large retailer by another Thai retail giant in late 2020 (which the TCC eventually approved with certain conditions), which put the TCC’s discretionary role in the spotlight and has become a landmark merger control case in Thailand.

Guidelines on Unfair Trade Practices

The object of the unfair trade practices provision of the TCA is to prevent any trade practices that cause damage to other operators. This provision has an extensive reach and may prohibit trade practices that have become common in some industries. Over time, the TCC will fine-tune their approach by observing and studying specific markets or industries and actively seek out unfair trade practices or arrangements and suffering parties. To date, the TCC has found four specific industries in which the commission has deemed it necessary to intervene and regulate market conduct of one party in order to protect another mistreated party. As a result, the TCC has launched market-specific guidelines for modern trade, franchise business, fruit trading, and—most recently—food delivery. To demonstrate more clearly how the TCC can intervene, the following section will look at this latest guidance in detail.

Food Delivery Guidelines

The COVID-19 pandemic brought phenomenal growth to e-commerce trading and food delivery services via online platforms, on which restaurant operators have become more and more dependent. The growing market power of the platforms prompted the TCC to issue guidelines to control the platform operators’ conduct, particularly when it comes to their trade practices and contract terms and conditions for participating restaurants.

The Guidelines on Unfair Trade Practices between Digital Platform Operators for Food Delivery and Restaurants were published in the Government Gazette on November 23, 2020, and took effect on December 23, 2020. The guidelines describe best-practice principles and indicate the arrangements, conditions, and restrictions that food delivery platform operators may or may not impose upon restaurants participating in their platform.

The main principle set forth in the TCC’s food delivery guidelines is that the business conduct and commercial conditions imposed by platform operators on restaurants must be fair, noncompulsory, and nondiscriminatory, and must not obstruct another party’s business operations. Furthermore, terms and conditions of the business arrangement should be written, clear, and justifiable.

The TCC’s guidance also contains the following list of conduct that could be deemed unfair under the TCA:

- Unfair charges, such as unjustified increases in commission fees or gross profit, discriminatory charging of different rates among similar restaurants, charging advertising fees or promotional expenses for no benefits in return, and unexpected charges or demands for remuneration or benefits.

- Setting trade conditions to impede the operations of competitors, such as prohibiting restaurants from participating in other food delivery platforms without justification.

- Unfairly exploiting superior bargaining power, such as by forcing restaurants to sell the same type of food at the same price in all sale channels without justification.

- Extending credit terms, terminating agreements, and excluding restaurants from the platform without justification.

The guidelines seem favorable to restaurant operators, who may now be able to avoid challenging these practices through potentially lengthy and costly legal proceedings. Instead, restaurateurs are given the right to file complaints with the TCC against food delivery platform operators that may have breached the guidelines. If found guilty, platform operators could incur a hefty fine—up to 10% of their last annual revenue—plus a cease-and-desist order from the TCC to bring the infringement to an end, or other remedial measures.

The TCC’s movements in this area exhort digital platform operators to review and reassess their agreements, business conduct, trade practices, and conditions or directions for restaurant operators. Platforms may also need to seek legal counsel to ensure that their planned actions will comply with the TCC’s guidance before they launch new marketing initiatives or modify existing terms and conditions, especially in relation to prices and fees for restaurant operators.

Conclusion

These guidelines for food delivery platforms are the first attempt by the TCC to regulate the e-commerce market, an industry that has developed rapidly in Thailand. The commission’s action here shows its intent to stay vigilant and ready to move on relevant emerging issues, and it signals that there could be further action on the conduct of e-commerce operators in Thailand if a need is seen. Overall, we can conclude that the revamped trade competition legal and regulatory environment in Thailand—starting with the updated TCA in 2017—has truly set in motion significant changes that aim to provide a fair and equitable field for doing business in Thailand.