Like many countries, Thailand requires stamp duty to be paid on the execution of certain legal instruments. A liable person who fails to pay stamp duty on a required instrument can be subject to a maximum surcharge of six times the applicable stamp duty, and an instrument on which stamp duty has not been paid will not be admissible as evidence in civil cases (that is, it will have limited legal weight and enforceability).

Before July 2019, there were three methods for paying stamp duty:

- Affixing adhesive stamps on the instrument (and canceling it by the liable person in order to make sure that the adhesive stamp duty cannot be reused);

- Having a stamp impressed on the paper instrument; or

- Filing a prescribed form and paying the duty by cash or cashiers cheque at an area revenue office.

In addition to paying the correct amount of stamp duty, the law also requires that stamp duty on certain instruments be paid using a specific prescribed method from the list above. Failure to use the prescribed method would be considered as that the stamp duty not having been paid.

For example, a hire-of-work instrument is subject to stamp duty, but if the remuneration stated within the agreement is at least THB 1,000,000 (approximately USD 33,500), the stamp duty must be paid by filing a prescribed form and paying by cash or cashier’s cheque at an area revenue office. Affixing adhesive stamp duty is not allowed in that circumstance.

E-Stamp Duty

In June 2019, the Revenue Department introduced a fourth method of paying stamp duty, allowing online payments in specific circumstances (e-Stamp Duty). After the launch of the e-Stamp Duty system, the Revenue Department issued a notification (Notification of the Director-General of Revenue concerning Stamp Duty (No. 58)) requiring stamp duty on five instruments that are executed in electronic format (e-Instruments), to be paid via the e-Stamp Duty system.

The five e-Instruments are:

- hire of work service instruments;

- loan instruments or bank overdraft instruments;

- powers of attorney (POA);

- proxy letters for voting at company meetings; and

- guarantee instruments.

To allow taxpayers to become acquainted with the e-Stamp Duty system, the Revenue Department issued another notification (Notification of the Director-General of Revenue concerning Stamp Duty (No. 59)) which temporarily allowed taxpayers to omit the use of the e-Stamp Duty system by paying stamp duty on these e-Instruments at an area revenue office instead. Originally due to end on December 31, 2020, the measure was extended to December 31, 2021, under Notification of the Director-General of Revenue concerning Stamp Duty (No. 61), and now applies to e-Instruments executed between July 1, 2019 and December 31, 2021.

The Revenue Department also issued a notification allowing taxpayers to use the e-Stamp Duty system to pay stamp duty on the same five instruments executed in the traditional paper format; provided that the instruments are executed during September 29, 2020 to December 31, 2021. Again, this was originally due to end on December 31, 2020 (Notification of the Director-General of Revenue Re: Stamp Duty (No. 60)), but has been extended to December 31, 2020 (Notification of the Director-General of Revenue Re: Stamp Duty (No. 62)).

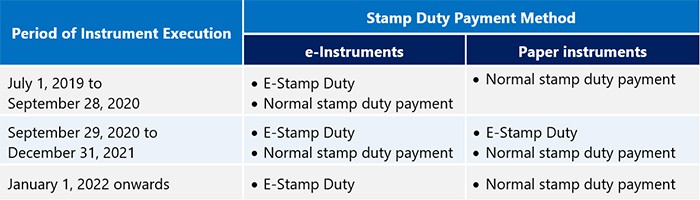

The table below summarizes the methods of stamp duty payment for the five instrument categories mentioned above.

Practicalities of the e-Stamp Duty System

The e-Stamp Duty system allows taxpayers to pay stamp duty online by filing the prescribed form (Form Or.Sor.9) through the website of the Revenue Department (www.rd.go.th) or the Revenue Department’s Application Programming Interface.

The e-Stamp Duty system allows taxpayers to file Form Or.Sor.9 and pay stamp duty before or within 15 days from the date of instrument execution. As of the date of this article, taxpayers can file a request to pay e-Stamp Duty no earlier than 30 days before the date on which an instrument is executed. If a taxpayer opts to pay e-Stamp Duty after executing an instrument, and the last date of paying stamp duty is due on public holiday, then the due date is extended to the next working day.

For example, if an instrument is due to be executed on March 31, 2021, the liable person can file Form Or.Sor.9 and pay e-Stamp Duty as early as March 2, 2021, or as late as April 16, 2021, (extended from April 15, 2021 which is a public holiday).

Taxpayers should note that the e-Stamp Duty system does not currently support late payment. Therefore, late filing and paying stamp duty will have to be done at an area revenue office.

After a taxpayer submits Form Or.Sor.9, they will receive a QR code and a pay-in-slip which can be used to make the e-Stamp Duty payment to the designated bank account of the Revenue Department.

Once the e-Stamp Duty is duly paid, the Revenue Department will generate a unique receipt code for the taxpayer to use as evidence of payment. This evidence of e-Stamp Duty payment can be downloaded from www.rd.go.th, or from the API (depending on where the taxpayer submitted Form Or.Sor.9).

Taxpayers should maintain the downloaded unique code and receipt for reference in the future. For instruments executed in paper format, taxpayers can maintain the downloaded unique code for reference in the future or print out the unique code and receipt and attach them to the instrument (instead of the usual official endorsement for paying stamp duty in cash at an area revenue office).