Thailand’s cabinet has approved draft legislation to impose a financial transactions tax (FTT) on securities trading in the Stock Exchange of Thailand (SET). The cabinet’s decision, which came on November 29, 2022, sets Thailand on a path to repeal a tax exemption that has been in place for over 30 years. If the legislation is ultimately passed, the FTT will be applied to transactions starting in April 2023.

The sale of securities on the SET has been exempt from specific business tax (SBT) since December 1991 in an effort to promote trading on the secondary market and boost the domestic economy. The draft legislation approved by the cabinet in November 2022 aims to repeal the SBT exemption on securities trading on the SET and impose an FTT, which is a kind of SBT imposed on a specific commercial transaction. It is an indirect and transactional tax (similar to a sales tax) and is imposed on gross receipts, not on value added at each stage of manufacturing, trading, or service like VAT.

Generally, securities sellers are the ones liable for FTT. However, the draft law stipulates that securities brokers are to withhold FTT from the gross share sales income and remit it to the Revenue Department on behalf of the securities seller within the 15th (or 23rd, depending on circumstances) day of the next month through the Revenue Department’s e-filing platform. Under this arrangement, securities sellers and investors do not have any duty to remit SBT, and sellers have no reporting obligations regarding sale transactions.

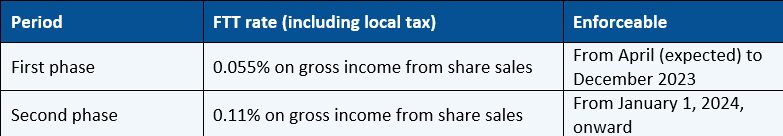

Under the current draft, the imposition of FTT will be implemented in two phases, with an initial reduced rate as detailed in the table below.

The securities subject to FTT include shares (both ordinary and preference), warrants, derivative warrants, exchange traded funds, depositary receipts, mutual fund units, and transferable subscription rights. Exempted persons include registered market makers, the Social Security Office, provident funds, the Government Pension Fund, aid funds under the Private School Act, retirement mutual funds, and the National Savings Fund, among others.

Securities traders may be subject to other tax implications besides FTT, such as capital gains tax and stamp duty, if a security is traded outside the SET. However, Thai and foreign individual investors can still be exempted from personal income tax on capital gains. Domestic companies may be subject to a capital gain at the prevailing rate of 20%, and foreign companies may be subject to 15% withholding tax on gains from a sale if payment is made from or in Thailand—though this rate may be reduced or exempted under the relevant Double Tax Agreements.

For more information on Thailand’s security-related tax requirements, or on any aspect of taxation in Thailand, please contact Auaychai Sukawong at [email protected].