On March 13, 2020, the Revenue Department of Thailand issued Notification of the Director General of Revenue Concerning Income Tax (No. 369) Re: Criteria, Methods and Conditions for Income Tax Exemption on the Purchase of Investment Units of Super Savings Funds (SSFs).

The tax incentives for investment in SSFs are intended as a substitute for the tax incentives for investment in Long-Term Equity Funds (LTFs), which were discontinued at the end of last year. The criteria and conditions for tax exemption under the SSF scheme are summarized below:

- In any tax year, a taxpayer may not make SSF investments in excess of 30% of their total taxable income for that year, capped at THB 200,000.

- The taxpayer’s total SSF, Provident Fund, Government Pension Fund, Private Teacher Aid Fund, Retirement Mutual Fund (RMF), Annuity Insurance Premium, and National Savings Fund investments and contributions must not exceed THB 500,000 in a single tax year.

- Taxpayers may invest in an SSF from January 1, 2020, to December 31, 2024 (5 years). There is no requirement for continual purchase of SSF units, unlike the rules for LTF or RMF investments. Taxpayers are eligible to receive tax incentives in any year that they invest in an SSF.

- There is no restriction on the holding period for SSF units. However, to enjoy tax benefits, the taxpayer must hold SSF units for a continual period of not less than 10 years from the date of purchase (except where the taxpayer becomes incompetent or deceased). If a taxpayer sells the SSF units before 10 years have elapsed, they will have to file an amended personal income tax return for the period that the tax exemption was claimed and pay additional tax with a surcharge of 1.5% per month (capped at the additional tax payment amount). Capital gains derived from the sale of SSF units will also be subject to tax in the year that they are sold.

- The taxpayer must retain the certificate of investment in the SSF issued by the asset management company to support the tax exemption.

- The taxpayer may transfer an investment in one SSF to another SSF. The transfer must be made within five working days of the SSF receiving an order to transfer from the taxpayer; otherwise, the investment period of 10 years will not be continued.

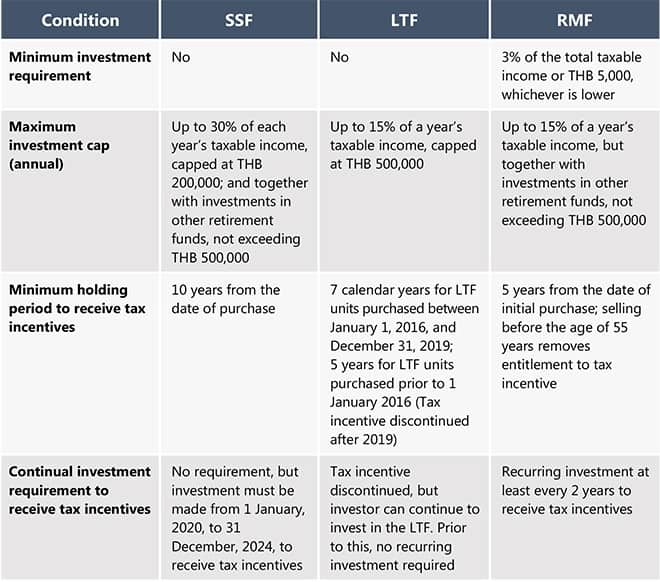

The major differences in the tax incentive conditions of SSF, LTF, and RMF investments are summarized in the table below.