On May 12, 2020, Myanmar’s Insurance Business Regulatory Board (IBRB) issued Directive 4/2020—a game-changer for the insurance industry in Myanmar. Previously, reinsurance in Myanmar had only been available through the state-owned Myanma Insurance, without competition. However, when this directive comes into force on October 1, 2020, insurance companies (or cedants) will be able to obtain reinsurance from other insurers or reinsurers within Myanmar or abroad, with certain restrictions.

Reinsurance (and retrocession—the insurance or reinsurance of reinsurers) is a critical part of the insurance industry because it allows insurance companies to spread their risk and remain solvent in the event of large claims. It is expected that this new directive will result in Myanmar insurers—already undergoing tectonic shifts following the introduction of five foreign life insurer licenses and six foreign-Myanmar insurance joint ventures—seeking substantial reinsurance outside Myanmar. This greater spreading of insurance risk is a very positive development for the insurance market in Myanmar.

Reinsurance and Risk Retention

Under the directive, every insurer in Myanmar must retain risk up to the maximum amount commensurate with its financial strength, and must formulate a suitable retention policy for each insurance segment. In the case of life insurers and reinsurers transacting life insurance business, that must be a minimum of 20% of the sum at risk.

Every Myanmar insurer must also formulate a reinsurance program and retention policy and submit it to the IBRB at the beginning of each financial year.

Reinsurers and Licensing

Any reinsurer who wishes to operate within Myanmar must have a reinsurance license from the IBRB.

Foreign reinsurers or cross-border reinsurers who do not have a license to conduct insurance business in Myanmar will now also be permitted, subject to the following conditions:

- They must have been licensed in their home country for at least the past three continuous years;

- They must have a credit rating of at least BBB from S&P or equivalent for at least the past three continuous years;

- They must have maintained a minimum solvency margin or capital adequacy as specified by their home country regulator for at least the past three continuous years;

- Their past claims settlement must be satisfactory to the IBRB; and

- They must comply with other requirements that may be stipulated by the IBRB.

Engaging a Reinsurer

Other than for life insurance, insurers must offer the best terms obtained to reinsurers in the following order:

- Myanma Insurance;

- Myanmar reinsurers or foreign reinsurers with representative offices in Myanmar; and

- Foreign reinsurers.

Insurers are obliged to follow this order of priority only if the terms offered are equaled (or bettered).

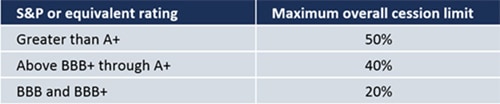

Again, other than life insurance, the IBRB has placed the following limits on cession to foreign reinsurers:

However, there is one catch that may prove frustrating. Section 20 of the directive provides that every Myanmar insurer, Myanmar reinsurer, and foreign reinsurer must cede a compulsory maximum of 10% of any insurance segment business to Myanma Insurance. Myanma Insurance is free to accept or reject the cession and will presumably be able to impose upon it such terms as it sees fit. Only if Myanma Insurance fails to offer such reinsurance is the insurer free to obtain cross border reinsurance from a foreign reinsurer for that original 10%. It seems probable that this provision will have a negative effect, because it will likely result in insurers being forced to comply with uncommercial terms from Myanma Insurance, despite better terms being available in Myanmar or abroad.

Insurance Pools

Insurance pools are another method by which smaller insurance companies can share risk. Insurance pools may now be formed in Myanmar, subject to a proposal being made to and approved by the IBRB.

Conclusion

Despite what some may see as the unwelcome involvement of Myanma Insurance, this directive is undoubtedly a giant step forward in the further liberalization and spreading of risk within the Myanmar insurance market, and is likely to herald large changes in reinsurance and retrocession both inside Myanmar and beyond.

For more information on this development, or on any aspect of doing business in Myanmar, please contact Tilleke & Gibbins’ Yangon office on [email protected].