Thailand’s new Land and Building Tax Act B.E. 2562 (2019) (the “Act”) came into effect on March 13, 2019. Payment of land and building tax under the new Act will be required from January 1, 2020, onwards.

The new Act revokes and replaces various pieces of formerly applicable legislation, including the House and Land Tax B.E. 2475 (1932) and its amendments; the Land Development Tax B.E. 2508 (1965) and its amendments; the Notification of the National Executive Council No. 156 dated June 4, B.E. 2515 (1972); and the Royal Decree Designating the Medium Price of Land for Land Development Tax Assessment B.E. 2529 (1986).

Under the Act, both individual and juristic persons who have ownership, possessory, or usage rights over land or buildings (including condominium units), as of January 1 of each year, will be required to pay land and building tax to the local administrative authorities. Payment will be due in April of each year.

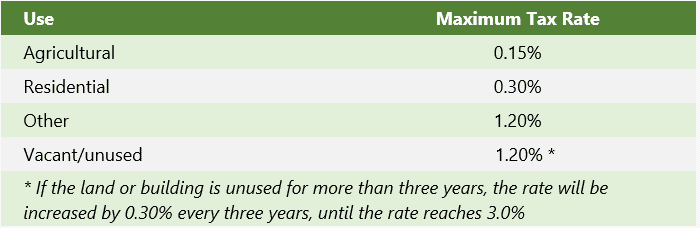

The official assessed price of the land, building, or condominium unit, as determined by the government authority for the purpose of collecting registration fees under the current Land Code, will be used as the basis for calculation of the land and building tax. The actual land and building tax rate that authorities will collect will be announced by royal decree in due course, subject to the fixed maximum rates, exemptions, and transition period rates outlined below.

Fixed Maximum Rates for Land and Building Tax

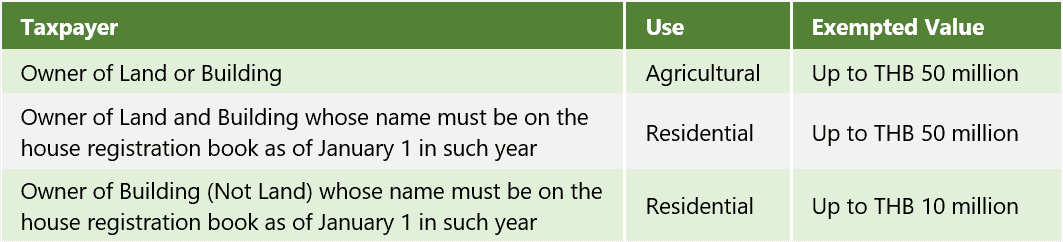

Exemptions

The Act provides limited exemptions to owners that meet the following criteria:

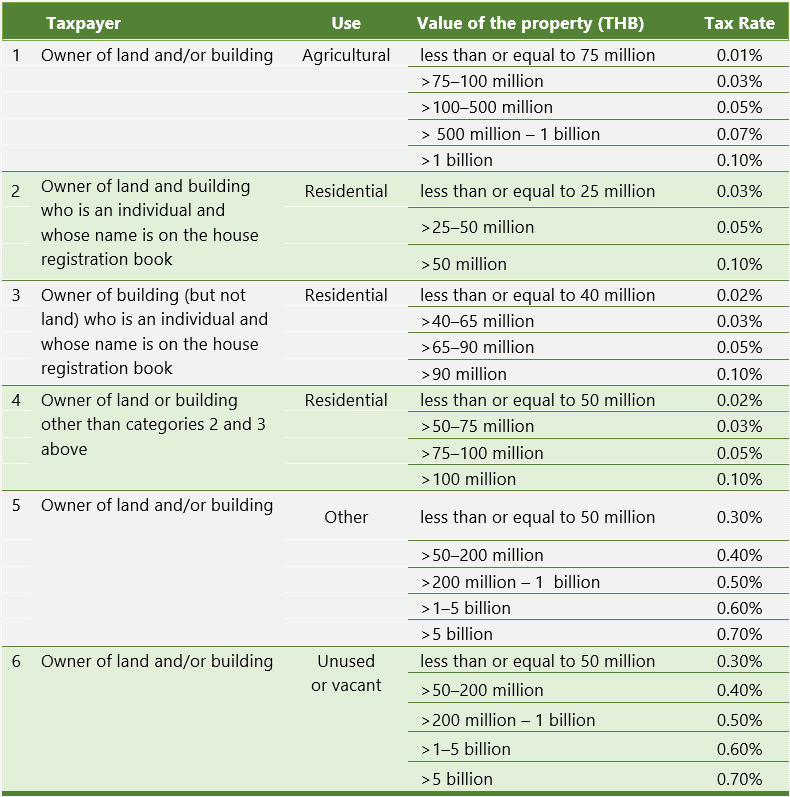

Transition Period Rates

For the first two years of tax collection under the Act commencing from January 1, 2020, the land and building tax rates will be reduced for the following land and/or building owners:

In addition, individual owners who use the land, or building, for agricultural purposes will be exempt for the first three years of tax collection under the Act.

For more information on the Act, or for any other enquiries, please contact our Bangkok office on [email protected] or on +66 2056 5555.